December is traditionally one of the slowest months in real estate, but last month told a slightly different story. While the holiday season and high mortgage rates kept demand sluggish, closed sales picked up more than usual for this time of year. Mortgage rates remained stuck above 7%, making affordability a challenge for many buyers, yet the market showed resilience as the year wrapped up.

Sold vs. Original List Price Analysis

Market Highlights:

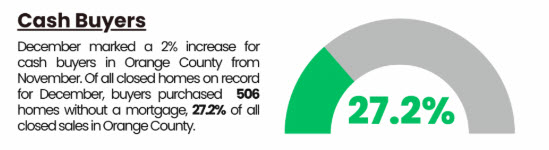

📊 Cash Buyers Increased – A notable 27.2% of all home sales in December were all-cash purchases, a 2% increase from November. This suggests that some buyers are navigating high mortgage rates by purchasing homes outright.

🏡 Price Trends:

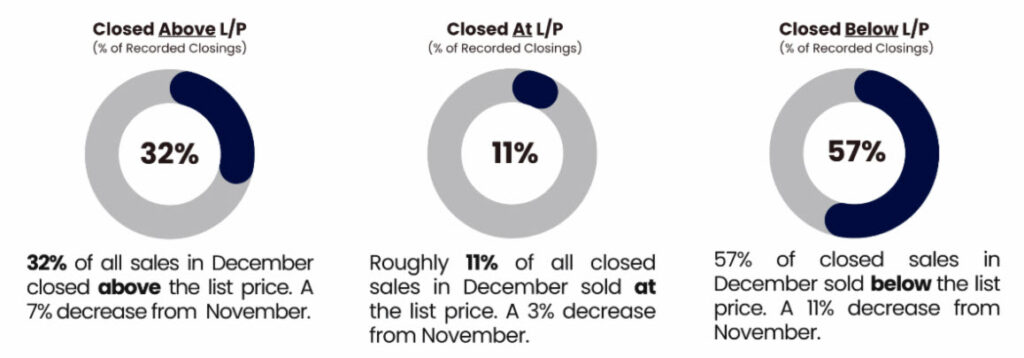

- 4% of homes sold above the list price, a slight increase from November.

- 67% of homes closed at their original asking price, showing stability in pricing.

- 29% of homes sold below the list price, a 10% jump from the prior month, highlighting the importance of proper pricing.

📉 Homes Pulled Off the Market – With the holidays in full swing, 738 homes (26.7% of total inventory) were withdrawn from the market, marking a 19% increase from November. Many sellers likely chose to wait for a better time to re-list.

What’s Next for 2025?

The new year is already showing signs of change. As January progresses, inventory is expected to rise slowly, while demand is likely to pick up. If mortgage rates dip into the 6% range, Orange County could see a much busier housing market than anticipated. For sellers, proper pricing will remain key in an elastic market, while buyers may find increased opportunities as more inventory comes into play.

🏡 Considering buying or selling? Now is the time to get ahead of the market. Reach out to discuss your real estate goals!

Interested in knowing the value of your home? Find out.